Calculate 401k contribution percentage

We Go Further Today To Help You Retire Tomorrow. Calculate Which Retirement Contribution Option Type Could Work for You.

Free 401k Calculator For Excel Calculate Your 401k Savings

10 Best Companies to Rollover Your 401K into a Gold IRA.

. Ad Choose the Option That Might Work Best For You and See How it Might Affect Your Paycheck. Using the Calculator to Estimate Your Future Earnings With this 401 k contribution calculator you can estimate what you will have saved in your fund when you plan to retire. We Go Further Today To Help You Retire Tomorrow.

Second multiply your gross income per pay period by the percentage youve elected to contribute to your Roth 401 plan to determine your 401 plan withholding. This number is the gross pay per pay period. The IRS also limits the total contributions to 401k accounts.

Step 4 Divide the rate of interest by the number of periods the interest or the 401 Contribution income is paid. To calculate the correct percentage to contribute divide the annual limit by the number of total yearly paychecks. The most you can contribute in 2019 is 19000 and those age 50.

The result should then be divided by your gross salary per. Contribution to 401k What proportion of your salary you will be saving into your 401K stated as a percentage of your salary. Your current before-tax 401 k plan.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Subtract any deductions and. Second many employers provide matching contributions to your account which can range from 0 to 100 of your contributions.

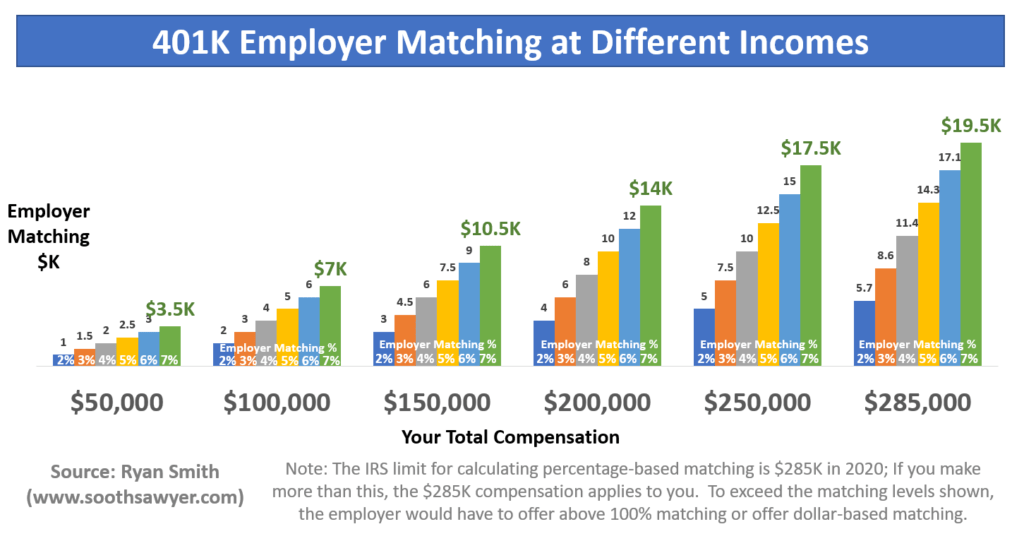

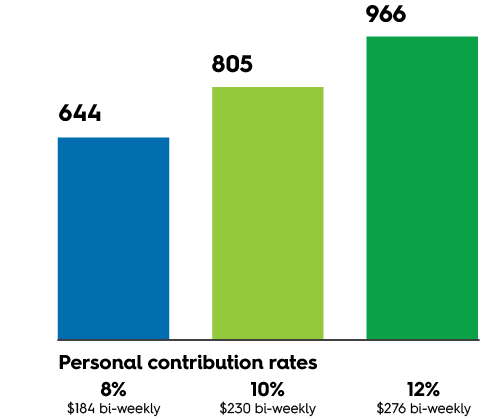

Employer Match This is how much your employer will match. Your employer match is 100 up to a maximum of 4. Open A Traditional IRA Today.

Ad Experienced Support Exceptional Value Award-Winning Education. Most retirement experts recommend you contribute 10 to 15 of your income toward your 401 each year. AddI Match Up to Investment.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Ad Learn About 2021 Traditional Contribution Limits. The calculator includes options for factoring in.

Find a Dedicated Financial Advisor Now. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

It provides you with two important advantages. First all contributions and earnings to your 401 k are tax deferred. Your employer needs to offer a 401k plan.

This 401 Retirement Calculator will calculate how much your 401 will be worth by the time you reach the age you plan to retire. The most common involves matching 050 of every dollar the employee contributes up to a set percentage of employee contributions sometimes called a partial. Ad Our 199 LLC formation service includes Bank Account provides everything you need.

Use this calculator to see how increasing your contributions. Employers usually set a limit on their match either as a certain dollar amount or as a percentage of the employees salary. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and.

TD Ameritrade Offers IRA Plans With Flexible Contribution Options. Some 401k match agreements match your contributions 100 while others match a different amount such as 50. Annual Increase Pay Period Contribution Current New Percent per Period Employer Match Match Up to For a two-tiered employer match.

Open an Account Today. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Open A Traditional IRA Today.

Evaluate how much your employer will contribute. To get the most out of this 401k calculator we recommend that you input data that reflects your retirement goals and current financial situation. You expect your annual before-tax rate of return on your 401 k to be 5.

Do Your Investments Align with Your Goals. You only pay taxes on contributions and earnings when the money is. If your benefits see.

For example if the rate paid is 9 and it compounds annually. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Ad Learn About 2021 Traditional Contribution Limits.

Form your Wyoming LLC with simplicity privacy low fees asset protection. Protect Yourself From Inflation.

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Customizable 401k Calculator And Retirement Analysis Template

What Is A 401 K Match Onplane Financial Advisors

How Much Can I Contribute To My Self Employed 401k Plan

D Dyosviq74 Um

Retirement Services 401 K Calculator

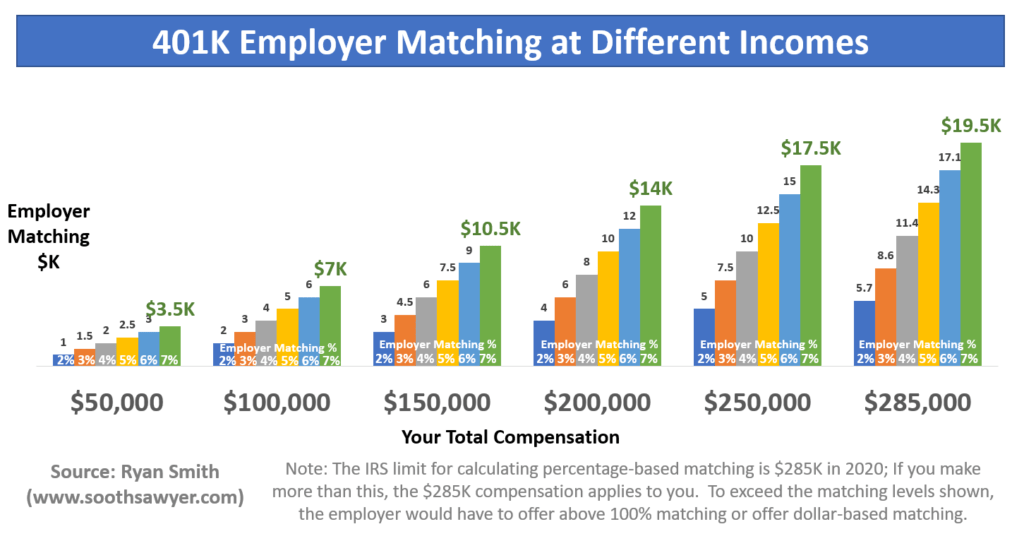

How Much Should I Have Saved In My 401k By Age

401 K Plan What Is A 401 K And How Does It Work

After Tax 401 K Contributions Retirement Benefits Fidelity

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

What Percentage Of People Max Out Their 401 K Financial Samurai

401 K Calculator See What You Ll Have Saved Dqydj

What Percentage Of People Max Out Their 401 K Financial Samurai

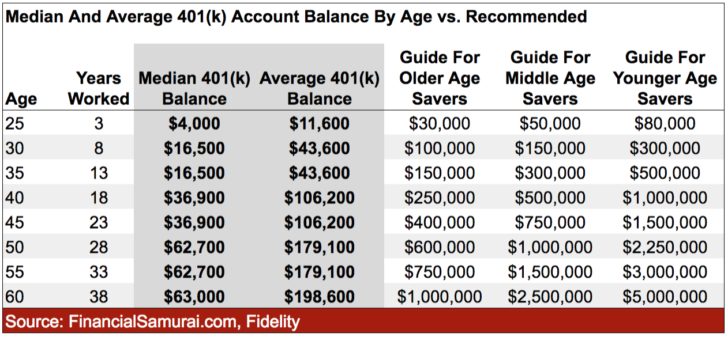

401 K Contributions How Much Is Enough Securian Financial

How Much Should I Have Saved In My 401k By Age

How To Protect Your Retirement Savings Fidelity Investments Investing Investment Portfolio Saving For Retirement

Doing The Math On Your 401 K Match Sep 29 2000